Online

Netherlands

Tax Avoidance: Crime or Business Skill?

Every individual or company is supposed to pay their taxes, but some clearly have their ways of dodging the system. Recently, the Pandora papers revealed that the Dutch minister of finance Wopke Hoekstra was involved in an investment via a tax haven. Hoekstra stated that what he did wasn’t illegal, according to the law. On the other hand, it is the ambition of Hoekstra and the Dutch government to change the image of the Netherlands as one of the biggest tax havens in the world. What is tax avoidance exactly and when is it legal? Does legality imply that it is fair? Who can avoid taxes and how? What implications does it have for society and does the Netherlands benefit from its role as a corporate tax haven?

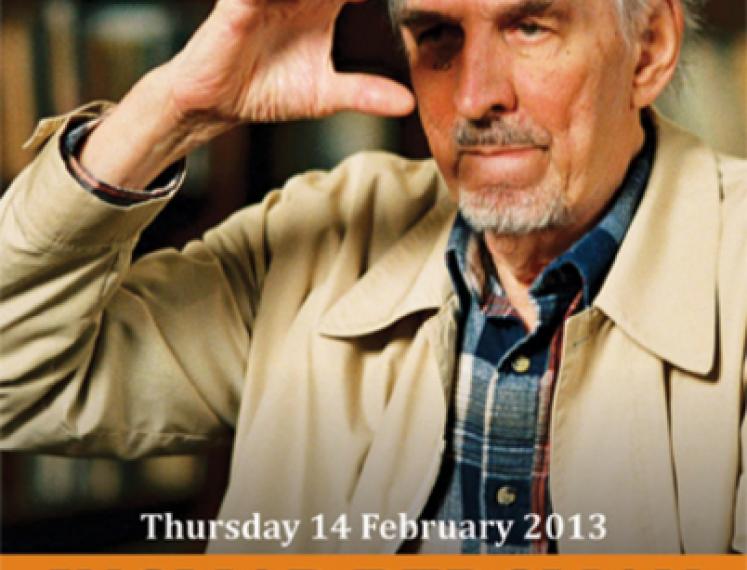

In this online edition of Let's Ask, Konstantin M. Wacker argues that the possibility to avoid taxes increases with market power and what policy makers can do to tackle this problem.

Konstantin M. Wacker is an assistant professor at the department of Global Economics and Management of the University of Groningen. He has worked and consulted for the World Bank, the International Monetary Fund, the European Central Bank, UNU-WIDER, and the Austrian Central Bank. He has done extensive research on multinational corporations and their foreign direct investment.

Let's Ask

In Let's Ask (before: Ask a Scientist) Groningen's finest researchers share their knowledge to provide context to that recurring 'thing' in the news and will answer your questions. In collaboration with Usva.